Understanding car title loan max amount involves assessing vehicle value (make, model, age, mileage), creditworthiness (credit score, debt-to-income ratio) and financial history. Lenders typically offer up to 50% of a vehicle's worth. Maximizing the car title loan max amount depends on maintaining a strong credit score and keeping your vehicle in good condition.

“Unraveling the mysteries of car title loan max amounts is crucial for borrowers seeking financial flexibility. This article guides you through the intricate landscape of credit scores and their impact on loan limits, offering valuable insights into maximizing your potential. From understanding the basics to factoring in influencing elements, we explore practical strategies to navigate these loans effectively. Discover how to unlock the full tapestry of car title loan options available to you.”

- Understanding Car Title Loan Limits

- Factors Influencing Maximum Amounts

- Maximizing Your Loan Potential

Understanding Car Title Loan Limits

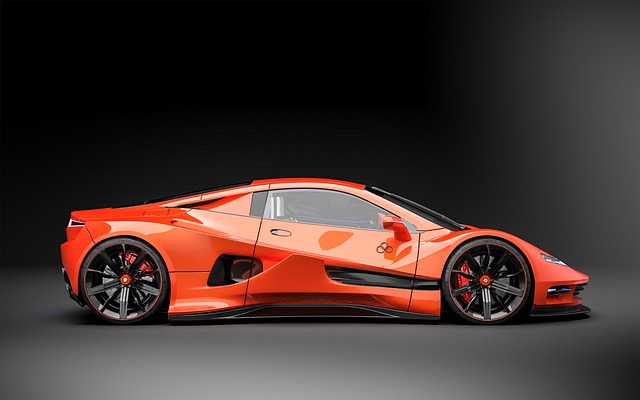

When considering a car title loan, it’s crucial to understand the maximum amount limits set by lenders. These caps are based on several factors, including your vehicle’s value, its age, and your creditworthiness, as assessed through your credit score. Lenders conduct a thorough vehicle inspection to determine the overall condition and market worth of your car, which directly influences the loan amount you’re approved for.

The car title loan max amount varies across lenders, with some offering up to 50% of your vehicle’s value. This provides a financial solution for immediate cash needs, but it’s essential to borrow responsibly. Knowing these limits in advance helps you set realistic expectations and make informed decisions about how much you can borrow without overextending yourself.

Factors Influencing Maximum Amounts

When it comes to car title loans, several factors play a significant role in determining the maximum loan amount an individual can receive. One of the primary considerations is the value and condition of the vehicle being used as collateral. Lenders assess the overall market value of the car, taking into account its make, model, age, mileage, and any existing damage or needed repairs. The higher the vehicle’s worth, generally, the larger the loan amount offered.

Additionally, lenders evaluate the borrower’s creditworthiness, which includes their credit score and debt-to-income ratio. In San Antonio Loans, a strong credit history can lead to higher borrowing limits as it demonstrates a lower risk for the lender. Loan extensions or debt consolidation may also be considered, allowing borrowers to access larger sums by combining multiple smaller loans or paying off existing debts with a single, more significant loan backed by their vehicle’s title.

Maximizing Your Loan Potential

Maximizing your loan potential with a car title loan is about understanding the factors that influence the maximum amount you can borrow. The most significant factor is your credit score, as it determines the risk for the lender. A higher credit score generally means you’re eligible for larger loan amounts and more favorable loan terms.

When considering a car title pawn, don’t overlook the value of your vehicle. Lenders assess the market value of your car to calculate the maximum car title loan max amount they can offer. Ensuring your vehicle is in good condition and has low mileage can help increase this potential. Additionally, being proactive about repaying existing debts and maintaining a positive financial history can significantly enhance your chances of securing a higher loan amount.

When considering a car title loan, understanding the maximum amount limits is crucial. By grasping the factors that influence these amounts and maximizing your loan potential through responsible borrowing practices, you can navigate this option effectively. Remember that each state has its regulations, so always check local guidelines regarding car title loan max amounts to ensure a secure and beneficial borrowing experience.