Understanding your car's value is key to determining the maximum car title loan amount. Lenders assess factors like make, model, and condition to set a loan-to-value ratio, influencing the borrowing limit. Online applications provide transparency, allowing borrowers to check potential amounts before applying. Market rates, vehicle condition, financial history, and state regulations all play roles in shaping your car title loan max amount.

Are you considering a car title loan but wondering about the maximum amounts available today? In this article, we explore the factors that cap car title loan limits and provide insights on maximizing your potential. Understanding these caps is crucial for making informed decisions. We delve into key influences, from vehicle value to lender policies, shaping the highest borrowing amounts. Learn how to navigate these limitations and unlock the best terms for your needs.

- Understanding Car Title Loan Limits

- Factors Influencing Maximum Loan Amounts

- How to Maximize Your Car Title Loan Potential

Understanding Car Title Loan Limits

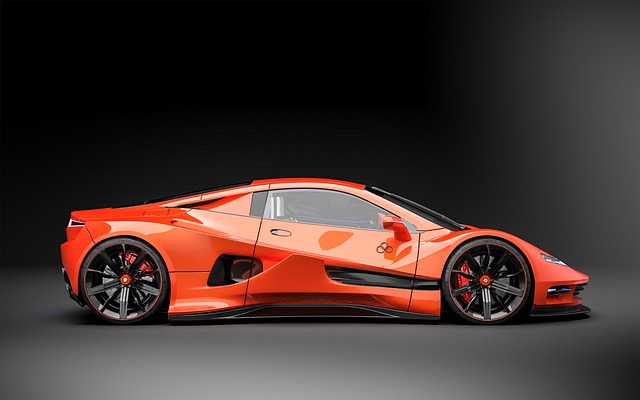

When considering a car title loan, it’s crucial to understand the maximum amount you can borrow based on your vehicle’s value. Unlike traditional loans where limits are often determined by credit scores and financial history, car title loans set their caps primarily on the worth of your vehicle. Lenders will evaluate your car’s make, model, year, and overall condition to determine a loan-to-value ratio. This ratio dictates the maximum car title loan max amount you can secure. Understanding these limits is essential when exploring short-term financial solutions like car title loans as it ensures you borrow responsibly within your means.

An online application process simplifies access to this information, allowing borrowers to check potential car title loan max amounts before submitting any paperwork. This transparency empowers individuals to decide if a car title loan is the right financial assistance for their needs without unnecessary stress or confusion about caps and restrictions.

Factors Influencing Maximum Loan Amounts

The maximum car title loan amounts available to borrowers are influenced by several factors. One key factor is the value and condition of the vehicle being used as collateral. Lenders assess the vehicle’s market value, age, and overall condition to determine a suitable loan-to-value ratio. This ensures that the loan amount doesn’t exceed the potential resale value of the car if the borrower defaults. Additionally, lenders consider the borrower’s financial history and ability to repay. A strong credit score can lead to higher loan amounts, as it indicates lower risk for the lender.

Another factor is state regulations and laws surrounding title loans. Different regions have varying caps on interest rates and maximum loan-to-value ratios, which directly impact the car title loan max amount. Some states have more lenient rules, allowing for larger loans, while others have stricter limitations to protect borrowers from excessive debt. Moreover, the lender’s policies play a role; they may set internal limits based on their risk assessment and target market, offering competitive rates and higher loan amounts to attract good credit applicants while keeping a conservative approach with Bad Credit Loans options.

How to Maximize Your Car Title Loan Potential

Maximizing your car title loan potential involves understanding both the market rates and your vehicle’s value. Begin by assessing your vehicle’s current condition and mileage to determine its maximum resale value. This information is crucial when applying for a car title loan, as it directly impacts the car title loan max amount you can secure. Many lenders in cities like San Antonio offer transparent borrowing guidelines, ensuring you know exactly how much you can borrow based on your vehicle’s assessed value.

Next, consider your financial situation and income to make informed decisions. Unlike traditional loans that often require a thorough credit check, car title loans are less stringent. This means even those with less-than-perfect credit could qualify for a loan. Additionally, the quick funding associated with car title loans allows you to access cash promptly, providing a safety net or funding for unexpected expenses.

Car title loans offer a quick solution for those needing cash, but understanding the maximum loan amounts is key. Various factors influence these limits, from your vehicle’s value to your credit history. By researching and comparing lenders, you can navigate these constraints effectively. Remember, responsible borrowing ensures you get the most from your car title loan without undue strain on your finances.