Lenders determine the car title loan max amount based on your vehicle's value, condition, and market worth, along with credit history and income stability. This process ensures safe, manageable borrowing for short-term needs, with interest rates and fees in mind. Accurately providing information during online applications is crucial to securing the highest possible amount. Car title loans offer quick funding (same-day cash) using your vehicle's title as collateral, ideal for unexpected expenses or business needs.

“Looking for a quick financial boost? Car title loans offer a unique solution with potential same-day cash. This guide breaks down everything you need to know about your car’s title loan maximum amount. Understanding these limits is crucial when accessing immediate liquidity secured by your vehicle. We’ll explore the factors that influence these max amounts and how to unlock the fastest cash possible, ensuring you make informed decisions in today’s fast-paced world.”

- Understanding Car Title Loan Maximums

- Factors Influencing Your Maximum Loan Amount

- Unlocking Same-Day Cash Potential

Understanding Car Title Loan Maximums

When considering a car title loan, understanding the maximum amount available is a crucial step in deciding if this financial solution meets your needs. The car title loan max amount varies based on several factors, primarily the value of your vehicle and your ability to repay the loan. Lenders assess these factors to determine the highest feasible loan amount they can offer securely. This process involves evaluating your vehicle’s condition, age, and current market value, along with considering your credit history and income stability.

The car title loan max amount is designed to provide a financial safety net for borrowers, ensuring they receive a sum that aligns with their requirements while also being manageable within their repayment capabilities. It’s important to keep in mind that this loan type serves as a short-term solution for emergency funds or unexpected expenses, and it’s crucial to plan for the associated interest rates and potential fees when budgeting.

Factors Influencing Your Maximum Loan Amount

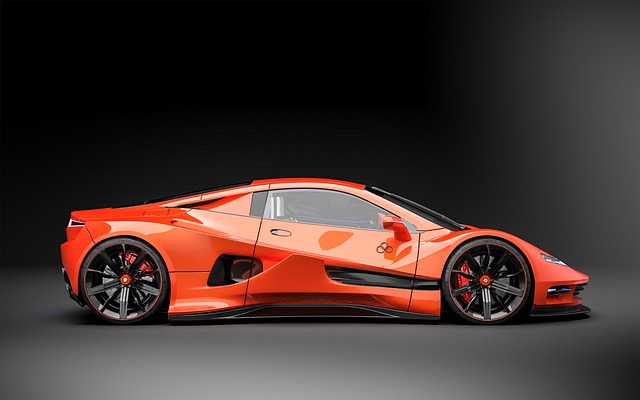

When applying for a car title loan, understanding your potential maximum loan amount is key. Several factors play a significant role in determining this limit. One primary consideration is the value of your vehicle; higher-valued cars typically allow for larger loans. The make and model, year, overall condition, and current market trends all influence this assessment. Lenders will also evaluate your credit history and financial stability to ensure you can manage the repayment process. A strong credit score can often lead to more favorable terms and a higher loan-to-value ratio.

Additionally, lenders may take into account your income and employment status. Demonstrating a steady income stream enhances your borrowing power, as does having a reliable source of funds for repayment. The process works best when you provide accurate and complete information during the online application for Dallas title loans or any other title pawn services. This transparency allows lenders to assess your financial health accurately and offers the best chance at securing the desired car title loan max amount.

Unlocking Same-Day Cash Potential

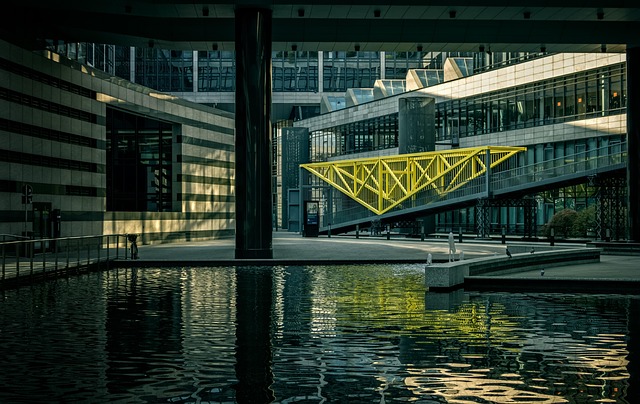

In today’s fast-paced world, accessing immediate financial support is often a top priority for many individuals and businesses. Car title loans offer an exciting solution with their potential to provide quick funding, especially when it comes to unlocking the maximum car title loan amount. This efficient method allows lenders to evaluate your vehicle’s value swiftly, ensuring you get approved for a substantial loan in no time. The process is designed to be straightforward, where your vehicle’s title serves as collateral, promising a hassle-free way to secure funds.

Same-day cash becomes a reality with car title loans, making it ideal for various situations, from unexpected expenses to business needs. Unlike traditional loans, which might require extensive paperwork and lengthy approval processes, semi-truck loans or car title loan payoffs can be finalized within hours, providing access to the maximum car title loan amount instantly. This rapid funding is a game-changer for those seeking immediate relief or capital injection without delays.

Car title loans offer a quick solution for urgent financial needs, and understanding the maximum loan amount available is key. By considering factors like your vehicle’s value and repayment capability, you can unlock same-day cash potential. Remember, while these loans provide fast access to funds, responsible borrowing practices ensure long-term financial stability.